If you’ve ever opened your paycheck and wondered why the number you take home doesn’t match your mental math, you’re in good company. Those little lines under “deductions” can feel mysterious. One of the most common—and helpful—entries is the medical pre-tax deduction. Put simply, this is money taken out for health benefits before taxes touch your pay. The short version: less taxable income can mean more in your pocket. Nakase Law Firm Inc. often hears from both workers and business owners who ask, what is the medical pre-tax deduction, and why it makes such a difference in how much employees keep in their pocket each month.

And here’s the thing that often gets missed: in places like California, payroll isn’t just math; it’s policy. Rules sit behind the scenes. California Business Lawyer & Corporate Lawyer Inc. regularly reviews payroll practices to make sure companies are handling deductions in line with the California labor code, because mistakes here can lead to disputes, penalties, or unhappy employees.

How this works, in everyday words

Picture this for a moment: your monthly pay is $4,000. You chip in $300 for your health plan. If that $300 is taken out before taxes are calculated, the system treats $3,700 as your taxable income. So your tax bill is based on the smaller number, and your take-home pay can look better than it would with after-tax deductions.

Most employers run this through a Section 125 (cafeteria) plan. The name sounds technical, yet the goal is simple: keep the process legal and tax-friendly so your benefits come out the smart way.

What usually counts as a medical pre-tax deduction

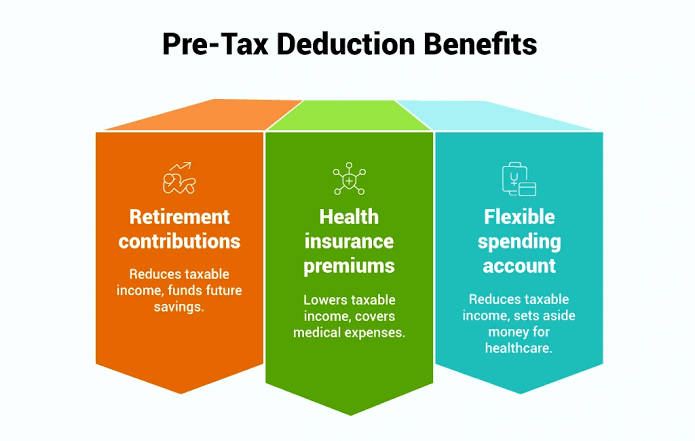

Health insurance premiums top the list, though there’s more. Common items include dental and vision coverage, Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs).

Think of a parent with two kids. The oldest needs glasses already, and the younger one is squinting at the TV remote. By paying vision premiums pre-tax and tossing a little into an FSA, that parent trims taxable income and keeps routine care within reach. Real life wins often look small like this—and then add up.

Why employees tend to like it

First, saving on taxes feels good on payday. Second, the cost of care gets spread across pay periods, so it stings less. Plus, those accounts meant for medical expenses can turn a stressful checkout into a quick swipe.

A familiar scene: you’re at the pharmacy counter with a prescription you didn’t plan for this month. You remember the FSA card in your wallet, use it, and walk out without wrecking your grocery budget. That tiny relief is exactly what these benefits are set up to provide.

Why employers get value from it too

Lower taxable wages can mean lower payroll taxes for the company. For a team of twenty or thirty people, that difference can be meaningful over a year. On top of that, offering a benefits package that helps employees keep more of their pay is a quiet way to retain good folks and attract new ones. It signals, “We’ve thought about your day-to-day life.”

Where rules step in

Federal tax rules frame what counts as pre-tax. States add their own layers. In California, for instance, deductions can’t pull pay below minimum wage unless the law allows it. That’s a guardrail to keep paychecks fair.

This is also where smart documentation matters. Written authorization for deductions, clear pay stubs, and accurate records help everyone stay aligned. Nobody wants a surprise audit or a dispute that could have been avoided with a simple form or a clearer handbook page.

Common slip-ups that cause headaches

A few patterns come up again and again:

- No written sign-off from the employee before taking a deduction

- Labeling a benefit as pre-tax when it doesn’t qualify

- Messy or incomplete records

- Deducting for items that don’t meet IRS rules

Here’s a quick story. A small business rolls out a new dental plan and mistakenly flags it as pre-tax. Months pass. At filing time, employees notice mismatches, and now the company has to correct W-2s and explain the mix-up. A five-minute checklist up front would have saved hours later.

One trade-off to keep in mind

Pre-tax deductions can lower the wages reported for Social Security and Medicare. So yes, you save now, and your reported wage for those programs may be a bit lower. For most people, the savings today outweigh the small shift in future benefits, yet it’s worth knowing about so you can make informed choices. That’s the practical balance many families try to strike.

Pre-tax vs. post-tax: a simple comparison

Think of pre-tax as getting a discount before the cashier totals your cart. Post-tax is paying in full and then buying extras afterward.

- Pre-tax examples: health insurance premiums, FSAs, HSAs

- Post-tax examples: union dues, garnishments

Not sure what you’re looking at on your pay stub? Ask payroll to show you where each deduction lands. Clarity here isn’t a luxury; it’s part of being paid correctly.

A quick self-audit for your pay stub

Want to double-check your deductions without turning it into a weekend project? Try this short list:

- Scan for a “pre-tax” label next to health-related deductions

- Compare the dollar amounts to the plan choices you made during enrollment

- If something looks off, ask HR or payroll for a breakdown

- During tax season, ask your preparer how these numbers flow into your return

Catching a mismatch early is easier than fixing it months later.

What smart communication from employers looks like

New-hire packets, open-enrollment emails, and a short FAQ can prevent most confusion. A five-minute huddle during onboarding to explain “what’s pre-tax and what’s not” pays for itself many times over.

Picture joining a company and seeing a few hundred dollars missing from your first check with no context. That’s an instant trust problem—and totally avoidable with a short, plain-spoken explainer document or a quick Q&A.

Everyday examples that make the idea click

- The parent with an FSA who covers a surprise urgent-care copay without dipping into rent money

- The new grad on a starter salary who keeps vision and dental affordable by paying those premiums pre-tax

- The small-business owner who notices payroll taxes tick down as more employees enroll in pre-tax benefits

None of these moments are flashy, yet all of them help real budgets stay steady.

Answers to a few common questions

- Does this mean my taxes always go down? In many cases, yes, because taxable income drops. That said, everyone’s mix of benefits and filing status is different, so the exact result varies.

- Can I change my pre-tax elections midyear? Usually only after a qualifying life event, like getting married or having a child. Your plan’s rules will spell it out.

- What if I don’t see the “pre-tax” label? Ask payroll for a line-by-line explanation. Better to clear it up now than guess.

Wrapping it all up

So where does this leave you? Medical pre-tax deductions help stretch paychecks and make the cost of care easier to handle. Employers benefit from payroll tax savings and happier teams. Employees benefit from lower taxable income and relief at the point of care.

The best outcomes show up when two things happen: employers run clean, compliant systems, and employees glance at their stubs now and then to keep everything aligned. Do that, and this quiet little line item can make everyday life a bit less stressful—and a bit more affordable.